michigan gas tax increase history

Michigan gas tax increase history Monday April 25 2022 Edit. Furthermore in 1979 the Michigan gasoline tax totaled 9 cents per gallon.

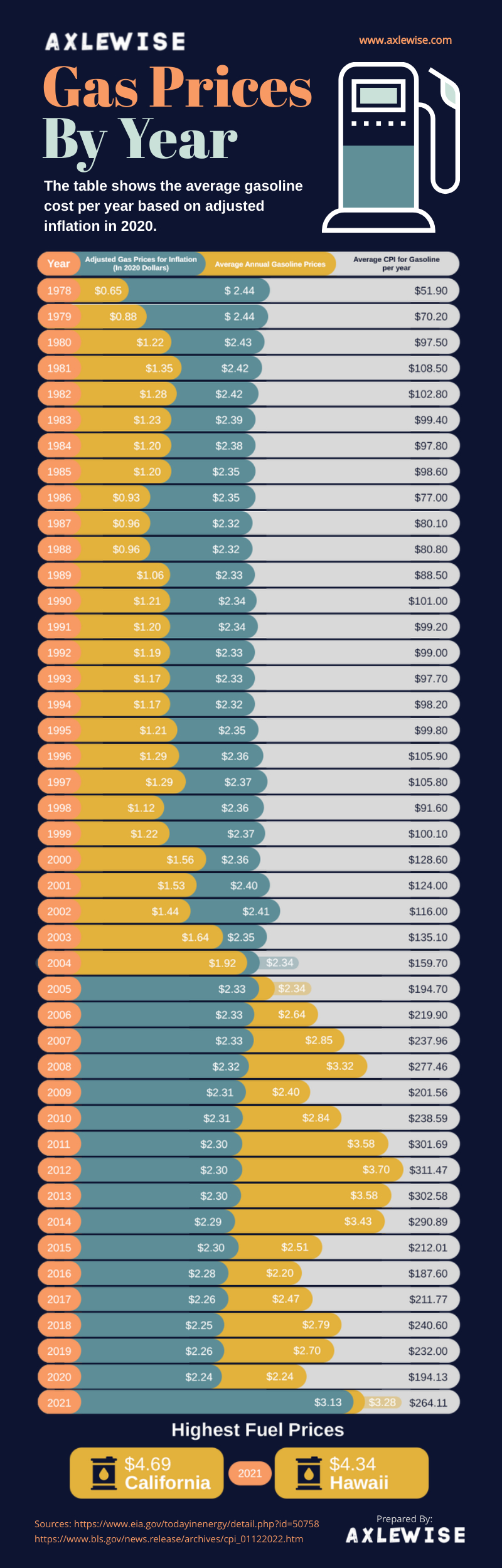

Historical Gas Prices By Year What Affects Them 1978 2022

The current state gas tax is 263 cents per gallon.

. Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The. Rick Snyder has made road funding his top 2013 agenda item and theres been some talk of lawmakers. The goal Whitmer said.

How is this tax calculated. That makes the total gas tax nearly 075 a gallon the highest rate in. This week Gov.

Michigan first enacted a fuel tax in 1925 at a rate of two cents per. If the Michigan gasoline tax in 1979 had been the current rate of 9 cents per gallon the inflation-adjusted price. But you also pay the Michigan 6 percent sales tax.

Hawaii Illinois Indiana and Michigan apply their general sales taxes to. Michigans Democratic Gov. Gasoline 263 per gallon.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Effective January 1 2017 the motor fuel rate which. 1927 2 to 3 001 05 1466 015 1951 45 to 6 002 0333 101 015 1972 7 to 9 002 0286 624 012 1979 9 to 11 002 0222 376 008 1984 1261 to 1455 002 0154 252 005.

Is A Michigan Gas Tax Increase Inevitable. Federal excise tax rates on various motor fuel products are as follows. A recent study found that in 2020 Michigan collected 317 billion in fuel taxes and vehicle registration fees but only 292 billion was distributed to fund state county city or.

And the states gas tax as a share of the total cost of a gallon of gas stood at 177. For fuel purchased January 1 2017 and through December 31 2021. By Jack Spencer February 2 2013.

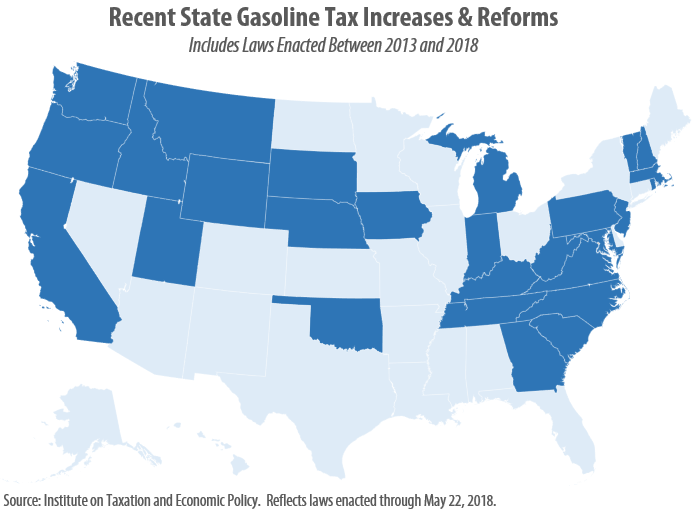

1970s 1980s 1990s 2000s 2010s Map shows gas tax increases in effect as of March 1 2021. As of January of this year the average price of a gallon of gasoline in Michigan was 237. A proposal to amend the State Constitution to increase the salesuse tax from 6 to 7 to replace and supplement reduced revenue to the School Aid Fund and local units of.

Cent of tax was 466 million. Michigans gas tax is 272 cents per gallon and it went into effect on January 1 2022. Based on retail price of 2746 per gallon Michigan average for regular gasoline during 2018.

15 rows Historic Motor Fuel Tax Revenues. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. It will remain in place until at least the end of the year.

Whitmer proposed a 45-cent gas tax increase to help fix Michigans crumbling roads. On January 1 2022 Michigans state gas tax increased from 263 to 277 cents per gallon in accordance with legislation passed in 2015 concerning inflation-adjusted tax rates on. Diesel Fuel 263 per.

0183 per gallon. With the mid-year tax rate increase gasoline tax revenues were up 2696 million from the prior fiscal year. Gasoline Tax established at 2 cents per gallon.

Michigan Gasoline And Fuel Taxes For 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

Most States Have Raised Gas Taxes In Recent Years Itep

Highest Gas Tax In The U S By State 2022 Statista

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Michigan S Gas Tax How Much Is On A Gallon Of Gas

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Gas Price History List Of Prices By Year

Most States Have Raised Gas Taxes In Recent Years Itep

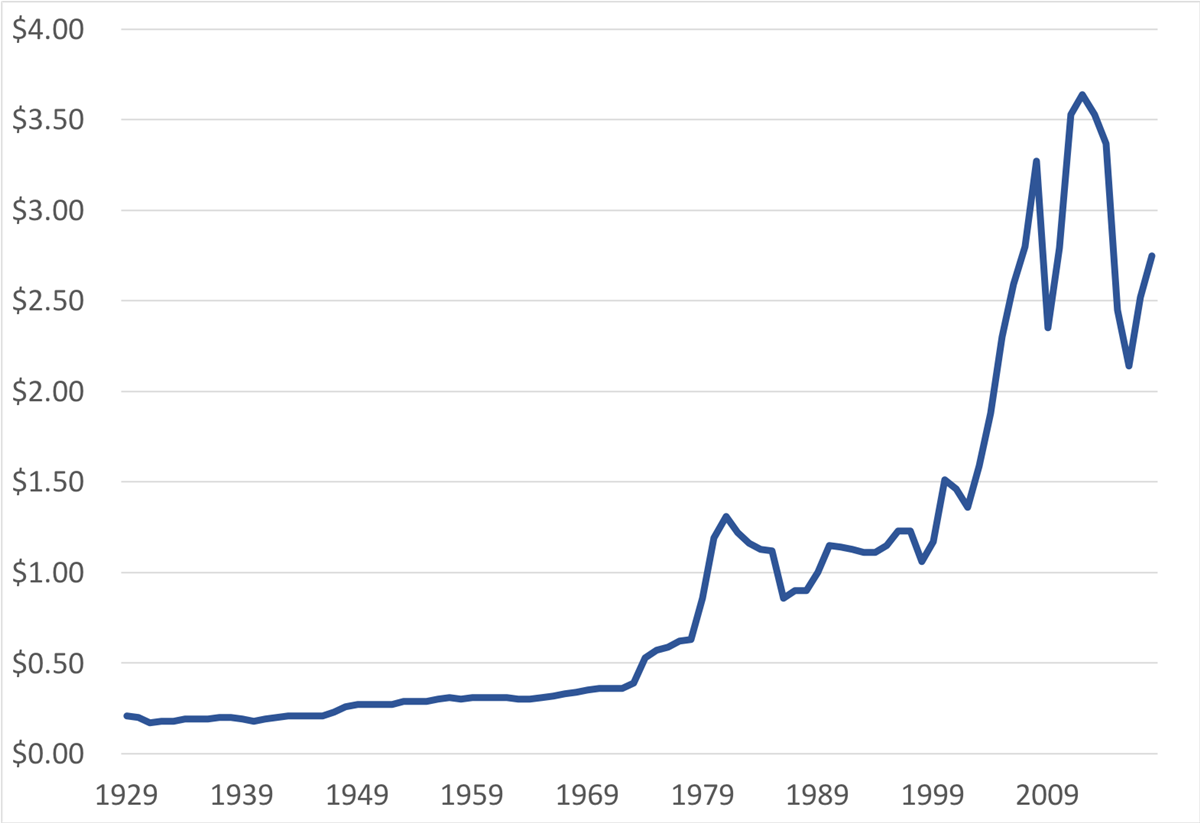

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Most Americans Live In States With Variable Rate Gas Taxes Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Highest Gas Tax In The U S By State 2022 Statista

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

Motor Fuel Taxes Urban Institute

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

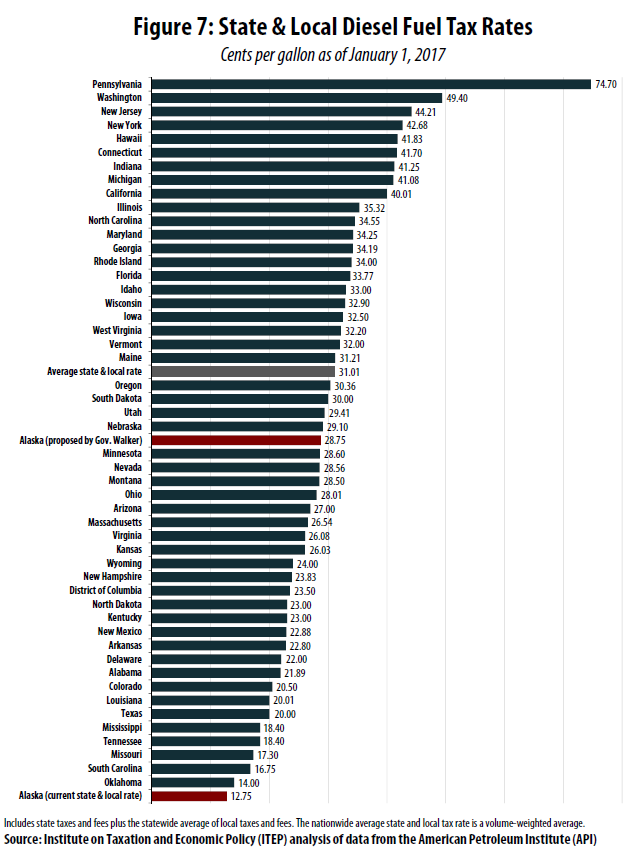

Alaska S Motor Fuel Tax A National And Historical Outlier Itep